Editor’s note: Jarrett Streebin is a Y Combinator alumnus and founder and CEO of EasyPost, a San Francisco-based startup with a simple shipping API. Follow him on Twitter @jstreebin.

Almost any time someone asks about the Y Combinator experience they ask, “Was it worth it?” It’s a difficult question to answer concisely given the complexity of such a program. During Y Combinator we had a chance to make a lot of friends, learn from experienced entrepreneurs, pitch to investors, and even sign up valuable early adopters.

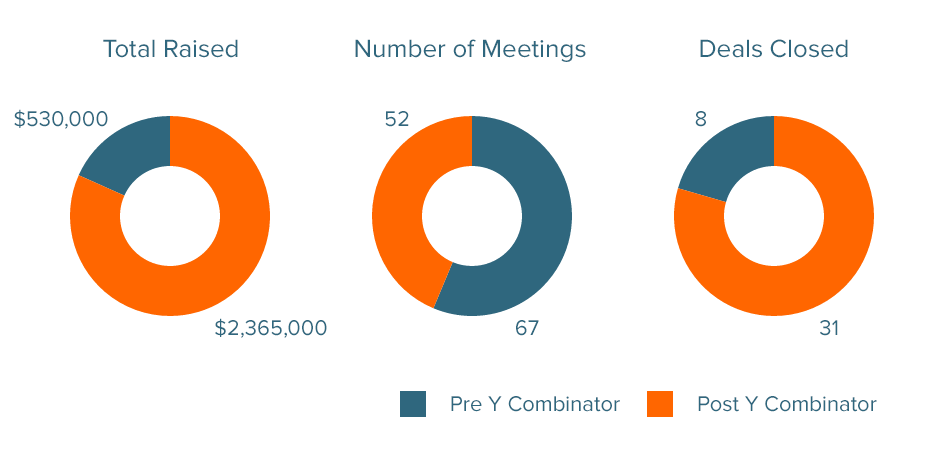

While it’s difficult to quantify many of these benefits, one area we can quantify is fundraising. We have been collecting data on fundraising since day one and were fortunate enough to attract investors both before and after YC. We looked back over the data recently to see if we could quantify what Y Combinator is worth.

Midway through the fundraising process, we realized that the single most important indicator of success (getting a check in the bank) was whether or not the investor was introduced to us (inbound), or whether we solicited them originally (outbound). On account of this we noted whether each investor was inbound or outbound.

Also, since we were attempting to measure the value of Y Combinator, we broke the groups of investors into two segments: before we found out we were accepted into Y Combinator and after. The first we’ll refer to as Pre-YC, the second Post-YC. This not a division of round or terms, just whether they were before we were accepted Y Combinator or after.

To date we’ve raised $3 million from SV Angel, CrunchFund*, Mesa+, Kevin Barenblat, Lars Kamp, Rahul Vohra, Ullas Naik, Shawn Bercuson, Initialized Capital (Garry Tan, Harj Taggar, and Alexis Ohanian), Sherpalo Ventures (Ram Shriram), Alex Polvi, Google Ventures, Charlie Cheever, Mike McCauley, David and Ryan Petersen, Jenny Haeg, Jody Glidden, Dalton Caldwell, Funders Club, Adrian Aoun, Fritz Lanman and Hank Vigil, Charlie Songhurst, Bill Lee, David Sacks, RightVentures, Capricorn, A Grade, Matthew Cowan, Sean Byrnes, Founders Fund, Valor Capital, Greg Kidd, Jeffrey Schox, and more.

This is excluding YC and YCVC ($20K notes from General Catalyst, Maverick, Sequoia, and Start Fund each).

Being “accepted” into YC is synonymous with securing an investment from YC; so we’re going to say that one’s presence in Y Combinator has no impact on whether or not Y Combinator chooses to invest.

In total we took 121 calls/meetings with potential investors, and received a check from 43 of them. That’s an average of $25,041.32 per call/meeting.

As we alluded to earlier, the most important difference was between inbound and outbound investors. To be clear, we’re defining inbound as either the investor contacted us directly, requested an intro, or someone in our network introduced the investor to us without our asking. Anything else (e.g. requesting the intro, contacting the investor, etc.) we considered outbound. We realized what a critical signal this was midway through our fundraising and adapted to it, as you will see in the breakdown of the two rounds.

All of our investors – every single one of the 43 – contacted us or requested an introduction through their network. Even when we were introduced by a friend at our request, these fared the same as all the cold outbound requests. What we realized is that when you request an intro the introducer is doing something they weren’t naturally inclined to do. If they had thought you were that hot of a deal they would have already introduced you. Not only are you decaying the relationship with the friend, but also that friend’s relationship with the investor, since they likely won’t invest in you (and won’t be as interested when they have a hot deal to show the investor). In our experience, the only intros that were worth anything were the ones that weren’t requested in any way. All others were a significant waste of time.

One last point on this, almost any VC will take a meeting with almost any entrepreneur. Why? Because that’s their job, to meet with entrepreneurs. It also means that if they schedule it on, say a Friday in SF at 11am, they can: a) avoid driving down to Sand Hill altogether, and b) arrive in Tahoe in time for a few evening runs. Be wary in thinking it’s anything more than that. The trajectory of your idea or company has yet to be set, and you’re burning valuable time chasing capital from unlikely sources instead of doing the most attractive thing to investors: building a valuable company.

We didn’t track time between meetings and close or money in the bank because we saw very little variance in that. Almost everyone that committed and signed the docs wired the money within two weeks. And if they didn’t they let us know if it was going through complaince or something (at larger funds).

Additionally, with first contact to commitment, 90 percent of the time this was within two weeks. There were about 10% that waited to decide, or waited for other investors to join the round, but I could count them on one hand and there was no difference pre or post YC.

Pre Y Combinator

Our first seed round began when SV Angel emailed us in September 2012, since that was our first fundraising discussion, and ended April 28, 2013 when we were accepted into Y Combinator.

Although we had SV Angel in from very early on, and then a few others, it took six and a half months to raise $530K from eight investors. Had we stopped after our third investor, Mesa+, we would have been at $450K over three months. Better, but not by much.

Post Y Combinator

Our second round of funding began that day we were officially accepted into Y Combinator, April 28, 2013. With that we were able to raise a quick $250K, stopped talking to investors for the duration of YC, and then began raising again a few days before Demo Day. Unlike our first round, we didn’t raise at all during Y Combinator, so the period lasted only about a month and a half. As you can see, we had a much easier time fundraising after being accepting into Y Combinator.

What Is Y Combinator Worth?

When it comes to fundraising the effect of Y Combinator cannot be overstated. In our case, Y Combinator meant raising more than four times as much money in a quarter the amount of time. We were able to attract more investors, and receive an investment from a higher percentage of them – spending less time in meetings and more time building EasyPost.

Does this mean you’re out of luck if you didn’t get into Y Combinator? Absolutely not. In raising $3m from 43 investors we learned a lot of ways to stack the cards in your favor. And since we learned many of them before we were accepted, they amplified the effects of Y Combinator dramatically.

*CrunchFund is owned by TechCrunch founder Michael Arrington.

Read more : Was Y Combinator Worth It?

0 Responses

Stay in touch with the conversation, subscribe to the RSS feed for comments on this post.