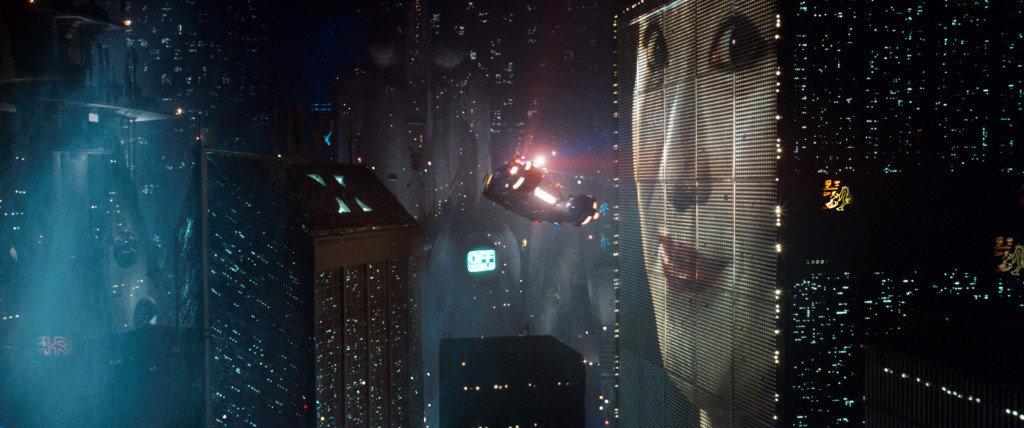

We live in the age of cryptocurrency heists, Chinese moon landings, eco-disasters and electronic cigarettes. Sounds like something out of a cyberpunk novel.

Well, a cyberpunk novel without the brain implants, but don’t worry, those are coming, too. But one big cyberpunk theme that hasn’t come to pass is the rise of mega-corporations — those huge multinational conglomerates, like Robocop‘s OCP, that owned everything from baby food companies to police departments.

Corporations are arguably more powerful today than ever before. But the economy isn’t dominated by a handful of megalithic conglomerates. it consists of hundreds or thousands of smaller, more specialized firms. Our cyberpunk future-present is dominated instead by a new power structure: the mega-network.

The Incredible Shrinking Firm

Science fiction is more about the present than the future, as the saying goes. And in the late 1970s and early 1980s — when the original cyberpunk stories were written — Wall Street was in love with conglomerates. But the love affair was over by 1990, according to a 1994 paper published in the American Sociological Review aptly titled “The Decline and Fall of the Conglomerate Firm in the 1980s.”

These diversified firms performed poorly on the stock market, and relaxed antitrust regulations meant that growing vertically was a safer legal bet than it was in the 1960s and 1970s, when conglomerates first took off. Many companies sold off their assets, becoming leaner and more focused on core competencies. Conglomorates are still popular in Asia and other parts of the world, but the U.S. business community generally agreed that conglomerates were a big mistake.

The fall of the conglomerate corresponded with white-collar downsizing, the rise of “permatemping,” and a general tendency towards smaller firms. But before we can answer why companies trended smaller, we should answer a more basic question: why do companies exist at all?

In 1937 Ronald Coase wrote a groundbreaking essay titled “The Nature of the Firm.” He set out to answer a question that vexed economists of his time: If markets were efficient, why was there a need for firm as all? Why didn’t all economic activity take place at the level of the individual, with everyone contracting everyone else? Coase concluded that there were transactional costs associated with doing business, such as negotiating contracts and protecting trade secrets. But a company could minimize those transaction costs by making it possible to avoid negotiating a contract for every single transaction, for example.

But technologies from shipping containers to software to web-based marketplaces are starting to smooth out those transaction costs, said Chris DeVore of Founders Co-Op in a talk at the Defrag conference last year.

“WordPerfect and VisiCalc transformed highly proprietary, document-based knowledge work into standardized digital files that could be copied, shared and modified by workers inside or outside the company,” he said. “This reduced friction in the transmission and reuse of information and further reduced the ‘hidden costs’ of distributing knowledge work among trading partners. As a result, more and more previously ‘core’ departmental functions — finance, accounting, marketing, sales — could now be farmed out to outside partners without a loss of fidelity.”

What’s arisen instead — and this was recognized as far back as the late 1980s — are virtual corporations: temporary alliances of businesses pursuing common goals. In other words, networks.

The Network

Take Y Combinator. “It gives the benefit of being part of a large company without being part of a big company,” Founder Paul Graham told Fast Company in 2012. “The problem with doing a startup — even though it’s better in almost every other respect — is that you don’t have the resources of a big company to draw on. It’s very lonely; you have no one to give you advice or help you out. In a big company, you might be horribly constrained, but there are like 1,000 other people you can go to to deal with any number of problems. Now [with YC] you have 1,000 people you can go to to deal with problems, and you don’t have all the restrictions of a big company.”

Y Combinator is just one sub-network of a larger network made up of angel investors, venture capitalists and entrepreneurs investing in each other, advising each other and occasionally also working for each other. Y Combinator is a slightly more formal network of individuals who have agreed to help each other out while the larger tech startup network includes many more informal connections between its members.

The “PayPal Mafia” is another famous sub-network within the tech network. PayPal co-founder Peter Thiel is a prolific investor in other startups, as are many early employees such as Jawed Karim and Dave McClure. And it’s not just individuals — companies invest in each other as well. Google has its own venture fund, Google Ventures. And in many cases the nodes of the network are in competition with each other. For example, Oracle invested in Salesforce.com and Netsuite — companies founded by former Oracle employees — which compete with each other and Oracle.

These aren’t subsidiaries. The individual pieces are truly independent companies. And though there’s a pecking order — some members of the network obviously hold more power than others — it’s non-hierarchical in the sense that there is no central authority. Instead there are islands of power distributed throughout the network.

It’s tempting to refer to this network as simply “Silicon Valley,” but it’s not actually limited to the Bay Area. Historically there was Route 128, and more recently cities like Austin and Seattle have become tech hubs. The tech network doesn’t end at the borders of the U.S. — there’s a bit of Russian oligarch money in the network, for example.

The network also crosses the public/private divide. In-Q-Tel is a venture capital firm started by the CIA but has now expanded to involve the larger intelligence community, including the National Geospatial-Intelligence Agency (NGA), Defense Intelligence Agency (DIA) and Department of Homeland Security Science and Technology Directorate (DHS S&T). The firm is an independent organization that makes investments in companies seen as useful to the intelligence community. For example, database startups 10gen (now known as MongoDB) and Cloudant both took investments from In-Q-Tel in 2012. And then there’s the surveillance industrial complex, which includes the Thiel-backed Palantir.

“Good old boy networks” and regional clusters of particular industries (like Wall Street and Madison Avenue) have existed before. But what seems to be happening now is that the tech industry network is growing and expanding. It’s not just a regional cluster, or a collection of regional clusters, dedicated to the technology industry. It’s growing to encompass many other industries.

When we say “software is eating the world,” what we really mean is that the software industry is eating the world. Information technology has long been a part of most industries. Back in 2004 Nicholas Carr declared the IT revolution over in his book Does IT Matter?, arguing that IT had gone from being a strategic advantage to simply being a cost of doing business.

But now the tech network competes with other industries instead of just selling software to them. Uber is the canonical example of software eating the world, but what it doesn’t do is as instructive as what it does. Uber doesn’t sell a white label dispatching software platform to existing taxi companies. Instead it started its own car service staffed by independent contractors.

Then there’s Tesla — another PayPal Mafia company — which is actually making cars. Or look at Silicon Valley’s obsession with reinventing food. Companies like Beyond Meat and Hampton Creek Foods aren’t software companies, but they’re backed by software investors. And while companies like 23andme and WellnessFX have a significant software component, the bigger story is that tech investors and entrepreneurs have moved beyond selling software to healthcare companies to starting healthcare companies.

The software network is diversifying and growing into the networked equivalent of a mega-conglomerate.

Forecast

The trend towards smaller companies and more startups is driven by another economic trend: more people are becoming rich. One in five Americans will reach affluence, at least temporarily, according to the Associated Press.

Make no mistake, many more people are entering poverty than are becoming rich — around 54 percent of Americans will experience poverty, according to the same AP study. But the growing number of wealthy people means there are more people with cash on hand and looking for places to invest it. Angel investing in tech companies has become an attractive option. Self-help author Timothy Ferris is forthcoming about this strategy, writing that he would rather invest in companies that he can influence and promote rather than put his money in stocks. Each successful startup means more newly rich startup founders looking for a place to park their money.

There’s a cultural issue as well. To paraphrase freelance writer and technologist Joshua Ellis, sometimes doing a startup just means that you’re too rich to work for someone else.

But there’s a dark side to this cycle. Peter Turchin of the University of Connecticut makes the case that although the wealth gap is a problem, the increase in the number of elites is an even bigger problem because it has historically led to more instability as the wealthy compete for a finite number of elite positions.

Maybe this won’t last. Maybe Google, which is becoming pretty diverse itself, will become the dystopian mega-corporation the cyberpunks feared. But for now it seems that the mega-network is here to stay. And if Turchin is right, we’re in for stormy weather.

Read more : Forget Mega-Corporations, Here’s The Mega-Network

0 Responses

Stay in touch with the conversation, subscribe to the RSS feed for comments on this post.