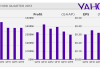

Yahoo just released its earnings report for the third quarter of the year, with revenue of $1.08 billion (minus traffic acquisition costs) and earnings per share of 34 cents. That’s in line with analyst estimates on the revenue side ($1.08 billion) and the estimated EPS of 33 cents.

Revenue is down 1 percent from the same period last year, while net earnings are down 91 percent, to $297 million.

“I’m very pleased with our execution, especially as we’ve continued to invest in and strengthen our core business,” said CEO Marissa Mayer in the earnings press release. “In Q3, we launched new user experiences across many of our digital daily habits — Yahoo Screen, My Yahoo, Fantasy Sports, and more. Now with more than 800 million monthly users on Yahoo — up 20 percent over the past 15 months — we’re achieving meaningful increases in user engagement and traffic.”

Focusing on specific segments of the business, Yahoo said its display ad revenue (again, minus traffic acquisition costs) is down 7 percent year-over-year, to $421 million. The number of ads sold (excluding Korea) is up 1 percent, while the price-per-ad decreased 7 percent. Meanwhile, search revenue ex-TAC was up 3 percent to $426 million.

In its previous earnings report, Yahoo also came in ahead of estimates, but revenue was essentially flat. Mayer has been touting Yahoo’s new and revamped mobile products, as well as its user growth, but the company doesn’t seem to have translated that into a significant improvement in the bottom line yet

In a separate announcement, Yahoo also said it’s reducing its sale of Alibaba shares by 20 percent.

Oh, and if you’re interested in asking Mayer a question that she might answer during the earnings call (which starts at 5pm Pacific), you can do so with the hashtag #YHOOearnings

Read more : Yahoo Q3 Barely Beats Estimates $0.34 EPS, Revenue Flat At $1.08B

0 Responses

Stay in touch with the conversation, subscribe to the RSS feed for comments on this post.