Dow Jones Venture Source released its quarterly report on the state of venture capital, including data on number of VC deals, funds raised, M&As and IPOs in the technology sector. According to the reprot U.S.-based companies raised $8.1 billion from 806 venture capital deals in 3Q 2013, a 2% increase in capital and a 4% decrease in number of deals from the previous quarter.

Compared to the same period in 2012, there was a 10% decrease in number of deals, while amount raised went up by 4%. The sectors to increase in amount raised were Business and Financial Services (46%) and Consumer Services (1%). By industry group, IT led the pack with 246 deals raising $2.3 billion and

accounting for 28% of total equity investment. Business and Financial Services saw $2.2 billion through 195 deals. Healthcare placed third with $1.8 billion in 164 deals. And $1.3 billion were raised by Consumer Services in 148 deals, a decrease of 10% in deal flow, while capital invested went up by 1%.

The largest deals in the quarter included Beat’s $500 million raise, Uber’s $258 million funding round, Palantir’s $200 million raise, and MongoDB’s $150 million round. The most active investors by amount of deals were in order, Google Ventures (25), Sequoia Capital (17), Andreessen Horowitz (17), Kleiner Perkins (16) and NEA (15).

M%A increased by 11% from 2Q 2013, with 111 deals garnering $9.7 billion. The number of deals also increased by 25 percent from the previous quarter. These included IBM’s $1 billion acquisition of Trusteer, and AOL’s $405 million purchase of Adap.TV.

IPOs seem to be seeing an uptick, with 25 companies raising $2.2 billion through public offerings in 3Q 2013. Both number of deals and capital raised increased from the previous quarter, with 25% and 24% increases, respectively. The largest IPOs of the quarter were FireEye and Violin Memory.

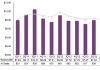

Median pre-money valuations decreased slightly by 7% from 2Q 2013. In terms of VCs themselves, firms raised 11% more funds than the previous quarter and saw the highest number of funds since 4Q’08. The data shows that 62 funds raised $4.1 billion in 3Q 2013, an 11% increase in number of funds, but a 47% decrease in the amount raised from the prior quarter. Greylock raised the largest fund in the quarter at $1 billion, accounting for 25% of the total amount raised in 3Q 2013. The median U.S. fund size was $123 million in the three quarters of 2013.

0 Responses

Stay in touch with the conversation, subscribe to the RSS feed for comments on this post.