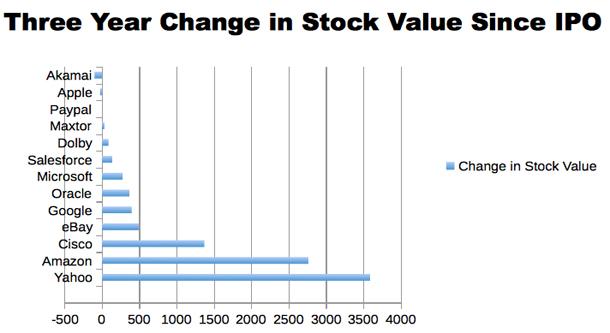

With the lackluster first day issue of Facebook on Friday, we thought we would take a moment to look at the memorable tech IPOs of the past and see how they have fared over the years. While the first day “pop” of some companies can generate news, what is more important is the longer-term performance of the stock – say, after three years of trading. The chart above shows some of these percentage gains – and losses.

One of the more memorable first-day increases was the doubling of share price for Netscape Corp. when it went public back in 1995 to raise the then-unheard-of sum of $1.6 billion. That’s less than 2% of what Facebook raised on Friday. Akamai raised twice what Netscape did in 1999 and had an increase of more than 450% in its first-day share price, only to fall to Earth three years later (thanks to the tech bust) and trade at 1% of its offering price. Ouch. Even Apple had “only” a 31% increase when it raised $3.4 billion in 1980 at its public offering. Three years after its IPO, it was down 25%. (Now is another story, of course.) And Paypal, which made billions for its owners and spawned an entire ecosystem of startups, was trading flat from its IPO three years later.

The biggest three-year percentage increases of popular tech stocks were Yahoo, with a 3,500% increase from its IPO, and Amazon, which rose more than 2,700%. Both benefitted from being on the right side of the tech bubble when they went public. Yet Yahoo has had its problems, as we have documented in the past. The last time its stock price broke 100 was at the end of 1999, and it hasn’t been anywhere in that neighborhood since then (right now, it is trading in the teens). Certainly, tech stocks are hot right now, and many – apart from Cisco and Microsoft – are close to their all-time highs including IBM and Amazon, both trading around 200.

One interesting trend not shown in the numbers is that all of the recent tech IPOs have come into the public markets with dual classes of stock shares, meaning that the public shares carry less voting rights (or in some cases, absolutely none) when it comes time for that annual shareholder meeting. Google will have three classes of shares next month: one for the founders, one for the public and then one with absolutely no voting power whatsoever that it will issue for dividends, employee incentive plans and acquisitions. LinkedIn, Zynga, Groupon and Yelp all have dual-class shares. James Surowiecki, writing in the New Yorker, says that this may “make the stock market less central to American capitalism.” A sobering thought indeed.

So what can we learn from this trip down memory lane? Just this: The first three years of a public tech company can be very chaotic times with regard to its stock. Some of the most successful companies didn’t make much money for normal shareholders. So if you are going to invest in a startup, start early, in its pre-money stage. Of course, that is pretty risky, too.

Read more : Tracking the Performance of Past Tech IPOs

0 Responses

Stay in touch with the conversation, subscribe to the RSS feed for comments on this post.