For a technology startup company to launch an initial product and survive long enough to gauge its success, requires two-orders-of-magnitude less money today than at the start of the previous decade. This from a man who knows from having made bigger investments that are smaller: Duncan Davidson, Managing Director of Menlo Park-based Bullpen Capital.

Bullpen is one of a growing number of early-stage funds – or, perhaps more accurately, “earlier-stage,” since even his is no longer the first out of the gate. In an interview with ReadWriteWeb, Davidson explains how the latest industry to receive the disruption treatment has been the venture capital business itself, with the epicenter of the quake right around San Francisco.

“There used to be the Four Horsemen of the IPO world, back in the ’80s and ’90s. They were some great, small banks: Robertson Stephens, Hambrecht & Quist, Alex. Brown & Sons, Montgomery Securities. They all went away; they got rolled up in 1999 and 2000 into these too-big-to-fail banking operations,” Davidson tells us. “The question is why? The answer is, they couldn’t make any money trading, [or on] giving analyst support for small stocks because the spread got too small.”

The spread he’s talking about is the decimalization of the U.S. stock market: The change led by NASDAQ in early 2001 to valuing stocks in increments from one-eighth of a dollar down to one cent. “When you make the spread a penny, only very high-volume stocks can garner economic value for the banks to be worried about it,” says Davidson. Firms that gave analyst support for small stock issues used to provide price target projections that had some meat between the bones because their highs and lows were separated by eighths of a point.

Believe it or not, this is where the change begins. When small fluctuations in stock value changed from 12.5¢ down to 1¢, the meaning of small stock got smaller. Decimalization forced analysts to tighten their spreads, the result being that their analysis looked like they were wasting their time commenting on penny stocks. It became unprofitable for the Four Horsemen to continue doing business independently. When they exited the scene, the small IPO market followed suit.

What followed is what the VC industry now calls “The Era of Cheap,” and we’re still very much in it.

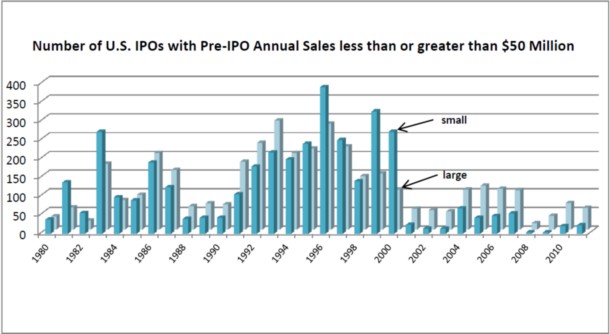

Number of U.S. IPOs by year, 1980-2011, with pre-IPO last 12-month sales less than (small firms) or greater than (large firms) $50 million (2009 purchasing power).

0 Responses

Stay in touch with the conversation, subscribe to the RSS feed for comments on this post.